Life's better with Portfolios

A simple way to invest and diversify your money for the long term.

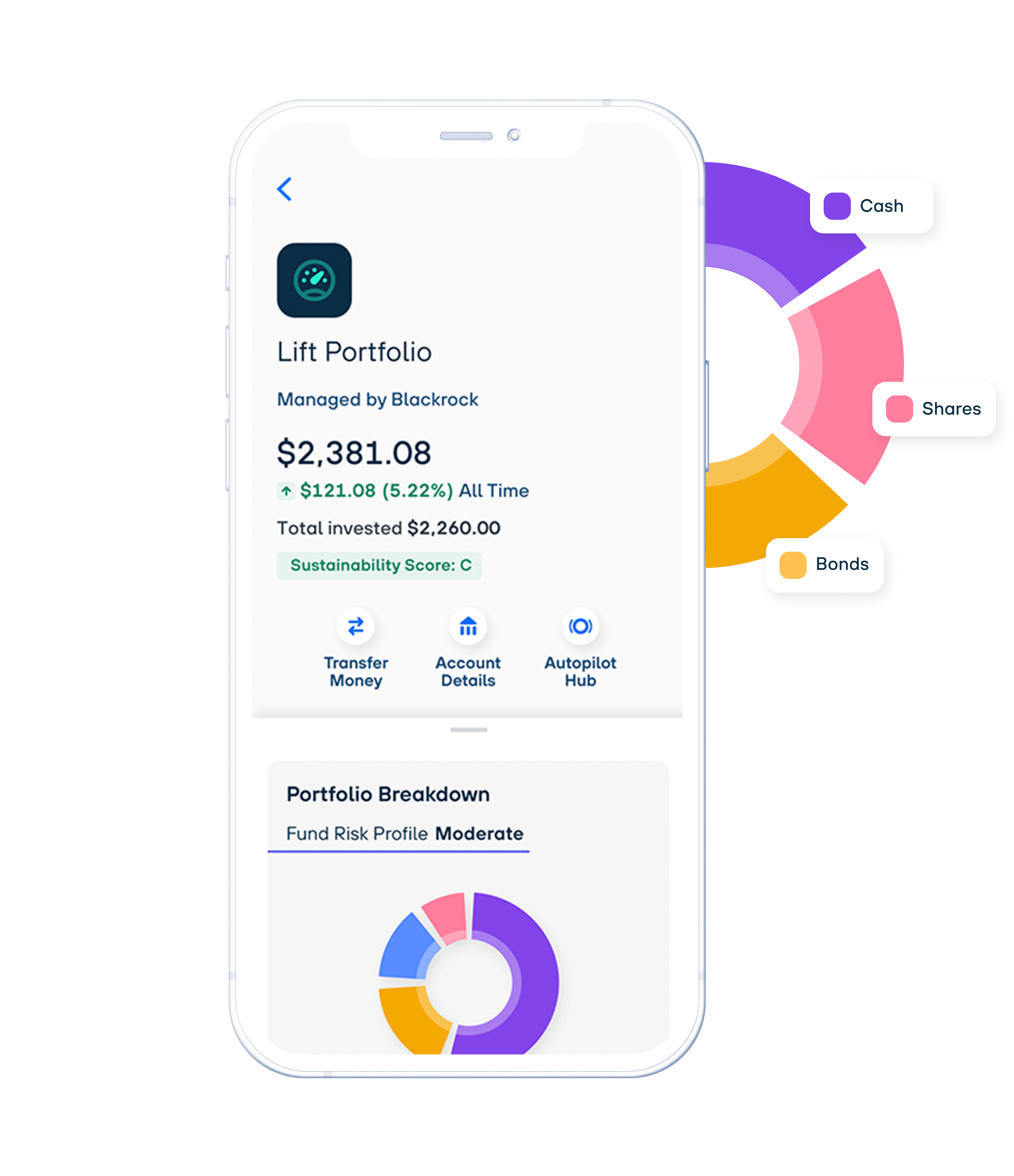

One investment, hundreds of assets.

Pick your comfort zone.

Core Portfolios give you instant exposure to a huge range of world-changing companies you know and love. Managed by the experienced market giants BlackRock.

Sustainable Portfolios give you instant exposure to a huge range of world-changing companies. Managed by BlackRock with a Sustainability focus, this one simple fund looks to offer similar risks and returns to Core portfolios.

Perks of Portfolios

Enjoy the freedom of having a single diversified Portfolio at the heart of your investment strategy.

A great place to start, whether you're a new investor or a seasoned expert.

Instant Diversification

Diversify from day one with exposure to a range of assets, industries and countries.

Managed by experts

BlackRock is the world’s leading Asset Manager. So, they know what they're doing!

Built for convenience

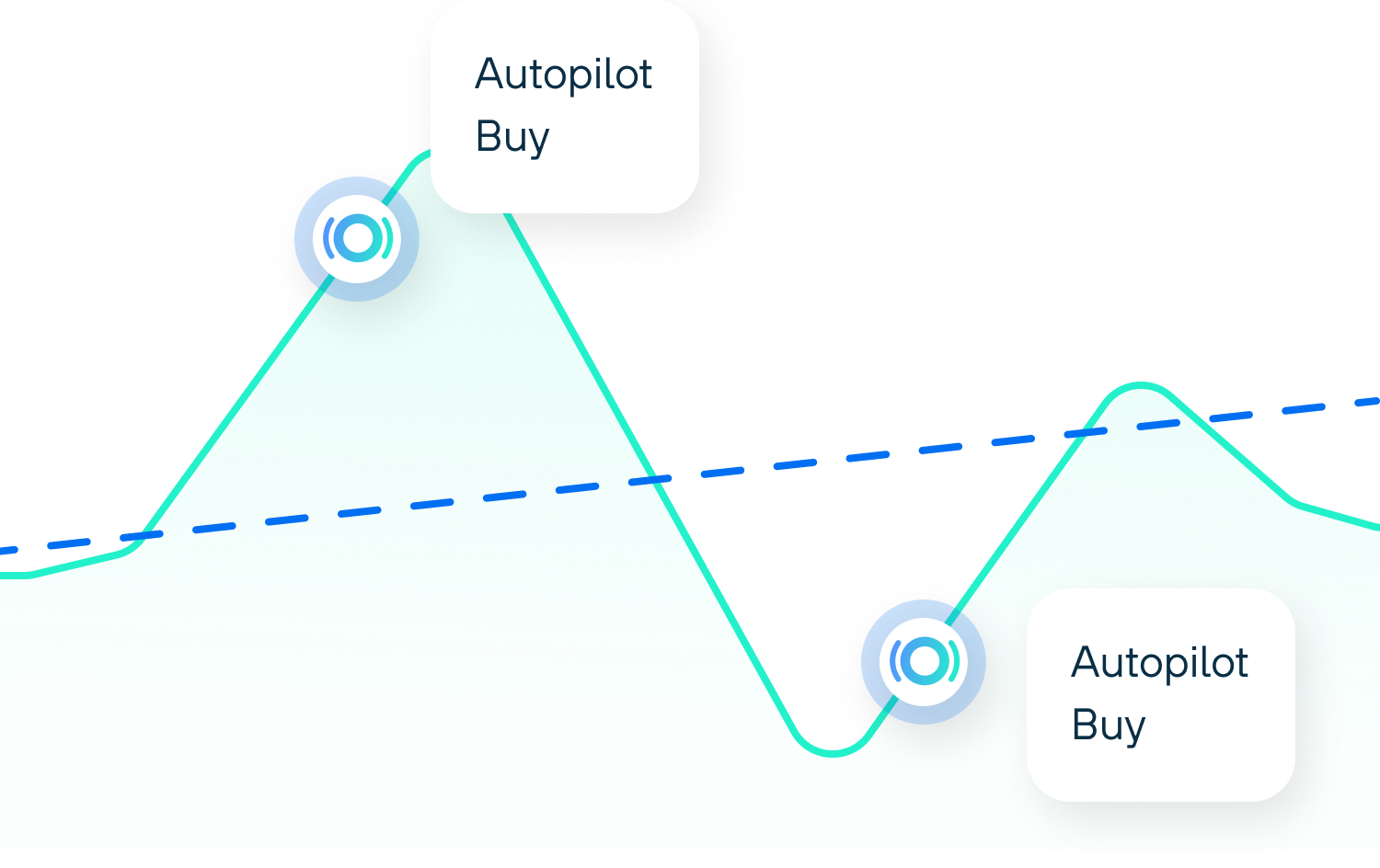

It's easy to set up a regular investment plan with Autopilot to suit any budget.

Remove the emotion

Take away the stress of trying to time the market. Ride out the highs and lows with little worries by investing at regular intervals.

Autopilot makes it easy

Set up a regular long-term investing plan. Control how much and how often, and we'll do the rest.

Managed by experts

It's now the world's largest asset manager and is the leading issuer of ETFs through iShares.

Simple, low fees

Build winning money habits with low monthly fees so you can invest more for your future.

How we compare

| Spaceship | Stockspot | Raiz | ||

|---|---|---|---|---|

| Monthly Fee | For account balances $50 or more Fee: $2.99 | For account balances $100 or more Fee: $2.00 | For account balances under $10k Fee: $5.50 | For account balances under $15k Fee: $3.50 |

| Management Fee | nil | 0.15%-0.50% pa of the net asset value of the fund | 0.66% per annum fee on balances over $10k | 0.275% per annum fee on balances over $15k |

Data valid as of 25/01/2023

Safe and secure

You're in safe hands, SIPC protected and managed by the largest fund manager in the world.

Designed for your protection

Your Investments are protected up to US$500,000 under Securities Investor Protection Corporation (SIPC) scheme.

It's all yours

All your investments are held in your name (yes, even fractional investments) and are expertly managed by the worlds largest fund manager, BlackRock.

Peace of mind

Our systems are designed with your protection in mind. Using state-of-the-art data encryption and in-app biometric security for all your transactions.

What our members say.

How to get started

It doesn’t have to be complicated, so we’ve made it easy!

Load it up

Start investing

Auto-repeat

Watch and learn your way to financial independence.

Learn InvestingYour questions answered.

What are Portfolios

Portfolios are a collection of shares we select and offer you via the app, independently managed by Blackrock.

Portfolios are investments independently managed by the world’s largest fund manager - Blackrock. Each portfolio comprises hundreds of different shares and ETFs, meaning you’ve got near-instant access to a diverse portfolio of global brands.

These portfolios are ‘multi-asset’, meaning Blackrock gives you different levels of exposure to different assets, depending on your risk appetite.

Through Blackrock, we offer six total portfolios for you to choose from, three Core and three Sustainable. Core and Sustainable each have a corresponding portfolio for conservative, moderate and aggressive risk appetites.

If you’d like more information on risk appetites, then have a read of What is a Fund Risk Profile?

Otherwise, head to What is in a portfolio to find out what they’re made of.

How do i choose a Portfolio

This one’s up to you! We don’t provide any advice when choosing a portfolio, but we do provide you with information about each one in-app.

Most importantly - we have substantial information about portfolios in the Douugh Academy; check it out! You can read, watch and learn your way to investing.

In the app, you’ll find the portfolio's past performance averaged since its inception. Remember, this is its past performance and not necessarily an indicator of how it will perform in the future.

You’ll see this when you swipe up on each portfolio. You’ll notice a pie chart that indicates what each portfolio is made up of, as well as links with further info.

Here are a couple of things to consider;

How much am I willing to invest regularly?

What portfolio fits my strategy best?

How much am I willing to risk?

Make sure you’ve thoroughly researched and considered your circumstances before making your choice.

How are portfolio investment strategies determined?

Portfolios are carefully selected by us and presented based on their past performance to you in the app. The Portfolios are independently managed by the world's largest fund manager, Blackrock.

A portfolio comprises hundreds of Shares and ETFs, giving you almost instant access to a diversified investment portfolio of global brands.

Our portfolios are ‘multi asset’. This means that Blackrock gives you exposure to different assets, depending on how much risk you want to be exposed to.

You’ll find detailed information about past performance, the composition of your portfolio and the prospectus when you swipe up on each Portfolio.

Do I own my Portfolio

Yes, you do!

Just like owning a share, you’ll be paid dividends (as applicable), and you’ll have a say in its direction when called to vote. All your holdings and cash are registered in your name in a segregated account and are insured for up to $US 500,000 under SIPC insurance.

For more information on shares take a look at Do I own my shares?